Customer expectations keep going up, and up, and up. Customers today don’t give your company or organization a “pass” because you’re in B2B, of financial services, or healthcare, or manufacturing. The greatest companies in the world, regardless of category, are teaching your customer what is possible and what is the norm.

Forrester says we are five years into “the age of customer”: an era of manifest customer expectations increases that will challenge almost every business. Specifically, their analysts say:

“The age of the customer will place harsh and unfamiliar demands on institutions, requiring changes in how they develop, market, sell, and deliver products and services.” ~ @forrester

Click To Tweet

To succeed in this environment, companies must look for every opportunity to understand customer expectations and continuously leapfrog past them, time and time and time again. The cycle for optimization of customer experiences is getting shorter and shorter too. What was a remarkable customer experience in 2016 is table stakes today. And to be able to continue to jump in front of rising customer expectations, your data and systems must be constantly getting better as well.

But data is both a blessing and a curse for CX professionals today.

Oracle CX produced a terrific report called 2018 Smarter Insights CX Report and discovered that 39% of surveyed CX pros believe they are under-proficient and underprepared for the new, data-rich era of customer experience management.

They know data is important, but they aren’t sure how to match the available data to on-the-ground CX improvements and enhancements. So what happens instead? They often sit around a conference room and come up with ideas, relying on instinct and anecdote to guide their initiatives. This CAN work, but isn’t the best approach.

Big Data + Machine Learning = CX Improvement RecipesBut using big data to guide CX decisions is doable. You just have to know where to look and how to read the numbers.

This was proven especially true by my friend Christopher S. Penn and his firm BrainTrust Insights, in their recently published white paper “Turning Complaints Into Insights.”

Studying the impact of complaints on your business makes a lot of intuitive sense, doesn’t it? After all, if you’re going to make a CX improvement, fixing whatever your customers complain about is a good starting point. In fact, I wrote a whole book about the science and importance of complaints, Hug Your Haters.

In their research, Penn and Co. analyzed 51,260 customer complaints from a credit reporting customer database to see what made consumers unhappy, which complaints were most emotional, what actions companies took (if any), and what impact those actions had on the company’s bottom line.

They first classified the complaints into one of five categories:

- Credit card and related issues

- Mortgages and related issues

- Fraud and fraudulent transactions

- Data breaches and compromised identities

- Bankruptcy and adverse financial events

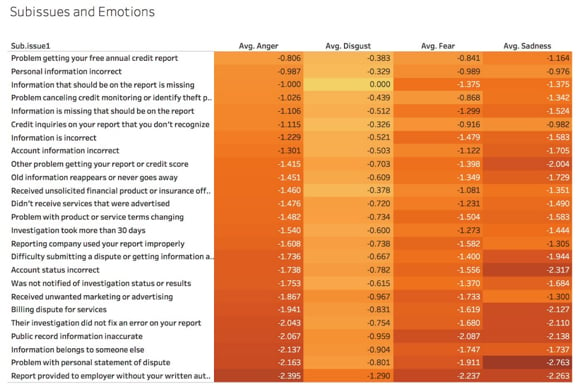

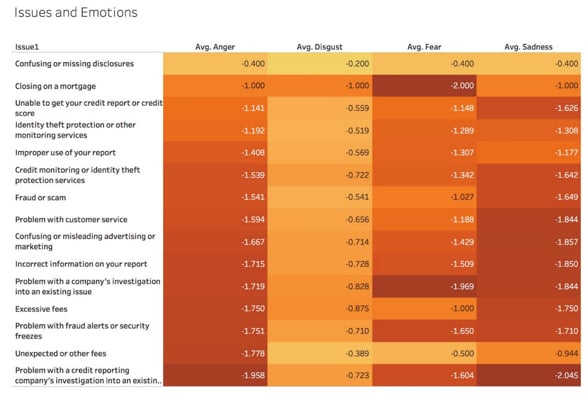

They then used two machine learning libraries to gauge the sentiment and emotional strength of each complaint, yielding a matrix of problem type and problem magnitude.

The darker the color in the table above, the more emotionally charged the complaint, indexed as anger, disgust, fear, or sadness. The data show that anger at its strongest (when consumers complain about credit reporting investigations, followed by unexpected fees and trouble with fraud alerts. Disgust is highest around issues of closing on a mortgage, and excessive fees.

And, there are several other issues—almost all of them operational circumstances that could be changed/fixed— that routinely are causing high-emotion customer complaints.

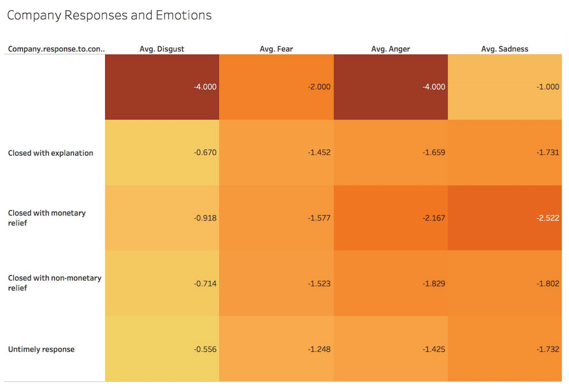

The team at Braintrust Insights then looked at the actual resolution of these complaints, organized by issue type, sentiment (anger, disgust, et al) and intensity (darkest colors in the chart above).

Row three in the table shows the complaints that are most emotionally charged are highly disproportionate to have been settled with some sort of monetary relief for the customer. This demonstrates a correlation between intensity and business-level outcome, and further emphasizes how important complaints are to company health.

How You Can Use Big Data to Improve Your Own CXWhat we learn in this example (and I encourage you to download the entire report, as there is a lot more gold in there), is that when you’re looking at customer complaints, you don’t have to rely solely on complaint volume or simple keyword analysis when classifying and categorizing them. The emotions prism through which this data was sifted is readily available.

Second, we learn that complaints and emotional intensity have a direct tie to business outcomes. People who are the most unhappy often have to be compensated monetarily, at least in this financial services example.

If you are looking to make specific customer experience improvements in your company—and you should be—a great place to begin your investigation into specific potential changes is to uncover the things about which your customers have the most intense feelings.

Good CX professionals use their instinct and experience to find and fix. Great CX professionals augment that expertise with big data and machine learning, peering into the numbers to find larger truths.

Big thanks to BrainTrust Insights for allowing me an early glance at this terrific report. They’ve got more interesting stuff on the way!

https://ift.tt/2K9MgCG

No comments:

Post a Comment